by Sandra Knight

Taxes can be daunting for a freelance writer or author, especially if it is your first year as a self-employed business owner.

Someone told you to keep everything related to your business and they were correct.

Now as you drag the big box from the closet where you have been tossing everything paper for your business, including all those receipts for the year, all you can think about is shoving it back in and closing the door.

Since you don’t have a choice but to go through this huge pile of paper, these simple steps will help you organize everything before you meet with your tax professional.

First Things First

Allow someone you trust to help.

Maybe swap service for service.

Working with another person can make the task seem less overwhelming.

Make sure you separate your business and personal information for your income and expenses.

This could be checking accounts, credit cards, receipts, invoices or any other items found in that big box.

You also want to separate your business income and business expenses.

Income as a self-employed author or freelance writer will usually be sent to you on an IRS 1099-MISC Form and you will receive one from each client that paid you to write.

Did you hire another freelance, contractor, etc. to assist you during the year (e.g., Fees paid to website developer, literary agent, editing and cover design fees, etc.)?

Did you send them a 1099-MISC form?

If you didn’t, this is a reminder to send one to each person you hired.

While this article is not how to do your taxes, we can all use a reminder from time to time as well as help those who have never done taxes as a self-employed author or freelance writer.

Set up Categories

It is up to you to decide how to enter and store your business income and expense information.

There are different types of accounting software or if you have been throwing your paper in that box in the closet, you could always start with a spreadsheet application which is easy to use.

Whichever method you choose, it’s time to set up some categories.

Everyone will have different categories based on their business but here are some ideas to get you started.

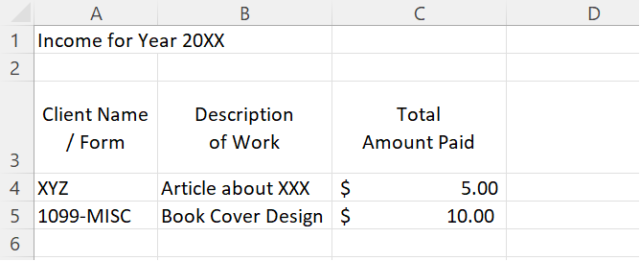

Income Records

Income can be from more than one source and each type of income will need its own column.

You could have royalties, affiliate commissions, book sales or articles you were paid to write.

If you still have a full-time wage income, you will need to provide your W-2 and any distributions for retirement, interest, or dividends.

Here is an example in a spreadsheet but you can add as many columns as you need for the income you receive:

While the titles above are good for gathering all your information all at once, there are other categories that can be added to track your income as you send your invoice out.

So, get to sorting your income documents and entering them into your spreadsheet.

Expense Receipts

When you make smart author or freelance writer deductions, you can reduce your tax burden by claiming as many expenses as possible.

Here are some ideas to get you started and you can check out this article for additional expenses to lower your tax bill.

- Part of home office/equipment (there are two ways to calculate how much you can deduct) and they are explained at Simplified Option for Home Office Deduction | Internal Revenue Service (irs.gov). Part of these expenses include, but are not limited to:

o Utilities.

o Insurance.

o Rent/mortgage.

o Telephone / internet.

- Paid Advertising

o Rented space to hold your book signing, costs of facility and caterer may be 100% deductible because your purpose for the event was to advertise and promote your newly released book.

o Ads, brand, and logo design.

o Flyers, brochures, business cards, etc.

o Promotional items or giveaways.

o Website costs.

- Selling items based on your book

o Tote bags, bookmarks, etc.

- Contractors, freelancers, and others you hire to design your book jacket, edit your book, or even a website developer.

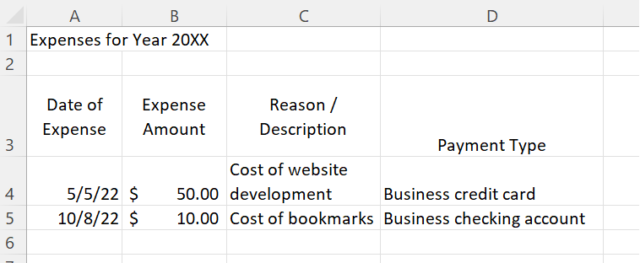

For every expense you need the date, amount, reason/description, invoice, payment type, etc.

You can use the same spreadsheet application you used for income but start a new tab for expenses.

Here is an example:

Once you have sorted all your receipts into categories, enter them into your spreadsheet.

After everything is entered into the spreadsheet, you can use the sum function to see the total amount of expenses you had for the year.

Make an Appointment with Your Tax Professional

When searching for a tax professional, it is a good idea to find someone who is familiar with freelance writers and authors.

You want to ensure you get the best person for you who already knows the ins and outs of a self-employed freelancer.

Here are some common dates your tax person might ask you to include:

• The go-live date of your self-employed business.

• The actual dates you were paid for any articles you wrote.

• The well-timed start date of your author website.

• The date you signed a contract for your book.

• The launch date of your book campaign.

• The lucky date you had your first book sale.

• The timely begin date you received the check for your book advance.

• The date you started advertising your services.

Organization

You finally finished gathering, sorting, and entering all your information and are ready to take them to your tax man. Whew!

Now, let’s talk about next year.

There are many tools to help you get and stay organized throughout the year.

You can stick with your spreadsheet, look for software your tax man recommends or look for additional options.

Keeper is an app you can use to track your receipts.

It was designed to help freelancers and contractors.

It is supposed to catch expenses that might be overlooked.

There are a few more options at Track Your Expenses as a Writer.

Look at different options.

You want to find what works for you and is in your budget.

Do your research and ask other freelancers what they like to use.

Once you have a process in place that works for your business, you will not have to think about that box full of paper that you started with the first time.

Finally, if you want this life, you need to become skilled in three very different activities: writing, publishing and business.

You must fulfil the expectations of your readers and followers, and you must figure out how you’re going to get properly paid and not find all the hours of every day consumed by work.

Source: The Ultimate Guide to Leveling Up Your Author Business — Self-Publishing Advice Center from the Alliance of Independent Authors (selfpublishingadvice.org)

About Sandra Knight

Sandra Knight and her husband live in the great state of Texas.

Sandra Knight and her husband live in the great state of Texas.

Sandra is a professional writer who creates content for businesses, including in-depth guides, educational reviews and engaging blog posts.

Her career focus is writing content in the personal finance space, and she is passionate about planning for the future and helping others. Learn more about her and her writing services at linkedin.com.